Spotlight on Life's Milestones

In life, certain moments stand out—moments that define who we are and shape the paths we take. These milestones, both personal and professional, offer us the chance to reflect, learn, and grow. In this series, "Spotlight on Life's Milestones," William Stanek invites you to journey with him through the pivotal experiences that have marked his life and the life of his wife, Hui Cha. Through these reflections, you'll discover how to embrace your own milestones with mindfulness and intention, transforming each significant moment into a stepping stone toward living well. Join us as we explore the rich tapestry of life’s milestones, celebrating the journey and the lessons learned along the way.

Transform your life with practical wisdom. Discover William Stanek's 'Living Well' series—your guide to a balanced and fulfilling life.

Discover William Stanek's Exclusive Art Collection

Explore and purchase the stunning art featured on this site. Own a piece of William Stanek's unique and captivating artwork today!

(December 22, 2024) Financial Milestones: Building Wealth and Security

Money plays a critical role in shaping our lives, influencing our choices, and contributing to our overall well-being. While it’s often said that money can’t buy happiness, financial stability and security are essential for creating a life of freedom, opportunity, and peace of mind. From receiving your first paycheck to achieving financial independence, the financial milestones we reach throughout our lives mark significant turning points that shape our future. In this article, we’ll explore the key financial milestones that define our journey, the importance of financial literacy in achieving wealth and security, and the lessons learned from navigating financial challenges.

The Importance of Financial Milestones: Markers of Progress and Security

Financial milestones are more than just points on a financial roadmap; they are markers of progress, security, and personal growth. Each milestone represents a step toward greater independence, freedom, and the ability to make choices that align with our values and goals. Whether it’s the thrill of receiving your first paycheck, the satisfaction of paying off debt, or the achievement of financial independence, these milestones are essential for building a life of security and satisfaction.

In my own journey, financial milestones have played a significant role in shaping my life. Growing up in poverty, financial security often felt like a distant dream, something that was always just out of reach. My family struggled to make ends meet, and the constant stress of financial instability was a heavy burden. But these early experiences also instilled in me a deep appreciation for the value of money and the importance of financial literacy.

One of the first significant financial milestones I reached was receiving my first paycheck. It was a moment of pride and accomplishment, a tangible reward for my hard work. But it was also a reminder of the responsibility that comes with earning money—the need to manage it wisely, to save, and to plan for the future. This milestone marked the beginning of my financial journey, one that would be filled with challenges, lessons, and ultimately, a sense of security and independence.

The Role of Financial Literacy: Empowering Financial Decisions

Financial literacy is the foundation upon which financial milestones are built. Without a solid understanding of how money works, it’s difficult to make informed decisions, plan for the future, or achieve financial security. Financial literacy empowers us to take control of our finances, make wise investments, and avoid the pitfalls of debt and poor money management.

For me, financial literacy was something I had to learn through experience. Growing up, there were few resources available to teach me about money management, saving, or investing. My early financial decisions were often guided by necessity rather than strategy, and it wasn’t until I began to educate myself about personal finance that I started to see the bigger picture.

One of the most important lessons I learned was the power of compound interest. The idea that money could grow over time, that small, consistent investments could lead to significant wealth, was a revelation. I began to prioritize saving and investing, understanding that the sooner I started, the greater the rewards would be in the long run.

Financial literacy also taught me the importance of budgeting—of tracking my income and expenses, setting financial goals, and living within my means. This discipline allowed me to build a solid financial foundation, to avoid unnecessary debt, and to plan for the future with confidence. Over time, I began to see the results of these efforts, reaching financial milestones that once seemed out of reach.

But financial literacy isn’t just about numbers; it’s also about mindset. It’s about understanding the relationship between money and life satisfaction, recognizing that financial security isn’t just about accumulating wealth, but about creating a life of freedom, choice, and peace of mind. By empowering ourselves with financial knowledge, we can make decisions that align with our values, prioritize our well-being, and build a future that reflects our true goals.

Navigating Financial Challenges: From Poverty to Stability

Financial milestones are often achieved in the face of significant challenges. For many, the journey to financial stability is fraught with obstacles, from growing up in poverty to dealing with unexpected expenses, job loss, or economic downturns. But it’s through these challenges that we learn the most valuable lessons about money, resilience, and the importance of perseverance.

In my own life, growing up in poverty presented a unique set of challenges. My family’s financial struggles were a constant source of stress, and the fear of not having enough was always present. These early experiences shaped my relationship with money, instilling in me both a deep sense of responsibility and a drive to achieve financial security.

One of the most significant financial challenges I faced was transitioning from poverty to financial stability. This journey was not linear—there were setbacks, unexpected expenses, and times when it felt like I was taking two steps back for every step forward. But each challenge was also an opportunity to learn, to adapt, and to build the resilience needed to continue moving toward my financial goals.

One of the key lessons I learned during this time was the importance of building an emergency fund. Life is unpredictable, and having a financial cushion to fall back on can make all the difference in navigating unexpected challenges. I made it a priority to set aside a portion of my income each month, gradually building an emergency fund that provided both security and peace of mind.

Another important lesson was the value of financial planning. Setting clear financial goals, creating a budget, and regularly reviewing my progress allowed me to stay on track, even when faced with obstacles. This planning also gave me the confidence to take calculated risks, such as investing in my education, starting a business, or pursuing new career opportunities.

The journey from poverty to financial stability was not easy, but it was incredibly rewarding. Each financial milestone I reached—whether it was paying off debt, buying my first home, or achieving financial independence—was a testament to the power of perseverance, discipline, and the lessons learned along the way.

Achieving Financial Independence: The Ultimate Milestone

For many, the ultimate financial milestone is achieving financial independence—the point at which you have enough wealth and income to support your lifestyle without the need for traditional employment. Financial independence represents freedom, the ability to make choices based on your values and desires rather than financial necessity, and the peace of mind that comes from knowing you have the resources to weather life’s uncertainties.

Achieving financial independence has been one of the most significant milestones in my own financial journey. It was the culmination of years of hard work, disciplined saving, and strategic investing. But more than that, it was the realization of a dream—a dream of freedom, of being able to pursue my passions without the constraints of financial stress, and of creating a life that reflects my true values.

Reaching this milestone required a combination of financial literacy, careful planning, and perseverance. I learned early on the importance of diversifying my income streams—of not relying solely on a single source of income, but of building a portfolio of investments, businesses, and other assets that could provide long-term financial stability.

One of the most important decisions I made on the path to financial independence was to invest in my education. Gaining new skills, expanding my knowledge, and pursuing opportunities for professional growth allowed me to increase my earning potential, diversify my income, and build the financial foundation needed to achieve my goals.

But achieving financial independence isn’t just about accumulating wealth—it’s about living a life that aligns with your values. For me, this meant prioritizing experiences over material possessions, focusing on long-term goals rather than short-term gratification, and using my financial resources to support the people and causes I care about.

Financial independence has given me the freedom to pursue my passions, to take risks, and to live a life that is true to who I am. It has also allowed me to give back, to use my resources to help others achieve their own financial goals, and to contribute to the well-being of my community.

The Relationship Between Money and Life Satisfaction

While financial milestones are important, it’s also crucial to understand the relationship between money and life satisfaction. Money, in and of itself, does not guarantee happiness, but financial security and independence can significantly enhance our overall well-being, providing us with the freedom, choice, and peace of mind needed to live a fulfilling life.

In my own experience, the pursuit of financial milestones has always been driven by a desire for security, freedom, and the ability to make choices that align with my values. Financial stability has allowed me to pursue my passions, support my family, and give back to my community in ways that are deeply meaningful.

But I’ve also learned that money is just a tool—a means to an end, rather than an end in itself. True life satisfaction comes from living a life that reflects your values, building relationships, pursuing your passions, and making a positive impact on the world around you. Financial security provides the foundation for these pursuits, but it is not the ultimate goal.

The key to achieving both financial success and life satisfaction is finding balance—between earning and spending, between saving and enjoying life, and between pursuing financial goals and nurturing your personal and emotional well-being. By understanding the role that money plays in our lives and using it wisely, we can create a life that is rich in both financial security and personal fulfillment.

A Call to Action: Build Your Financial Milestones

Financial milestones are essential markers of progress, security, and personal growth. By achieving these milestones, we can create a life of freedom, opportunity, and peace of mind, allowing us to pursue our passions, support our loved ones, and live a life that reflects our true values.

Here are a few steps you can take to build your financial milestones:

-

Educate Yourself: Invest in your financial literacy by learning about budgeting, saving, investing, and financial planning. The more you know, the better equipped you’ll be to make informed decisions and achieve your financial goals.

-

Set Clear Financial Goals: Define your financial milestones, whether it’s saving for an emergency fund, paying off debt, buying a home, or achieving financial independence. Set clear, measurable goals and create a plan to reach them.

-

Create a Budget: Track your income and expenses, and create a budget that allows you to live within your means, save for the future, and avoid unnecessary debt. Regularly review your budget and adjust it as needed.

-

Build an Emergency Fund: Prioritize building an emergency fund that can cover three to six months of living expenses. This financial cushion will provide security and peace of mind in the face of unexpected challenges.

-

Invest in Your Future: Start investing early, taking advantage of compound interest and long-term growth opportunities. Diversify your investments to reduce risk and build a stable financial foundation.

-

Seek Professional Advice: Consider working with a financial advisor to create a comprehensive financial plan, especially if you’re facing complex financial decisions or nearing major financial milestones.

-

Balance Money and Life: Remember that financial success is not just about accumulating wealth—it’s about creating a life that aligns with your values, supports your well-being, and brings you joy and satisfaction.

Your financial journey is unique, and the milestones you achieve along the way are essential markers of progress and growth. By building your financial literacy, setting clear goals, and staying disciplined in your financial habits, you can create a life of security, freedom, and fulfillment.

Embrace your financial milestones, prioritize your well-being, and continue on your journey of living well.

Join William at the crossroads of technology, business, and leadership, where true influence isn't about titles - it's about inspiring action, driving change, and guiding others with integrity. Discover how authentic leadership can transform not just careers, but entire industries.

Bring Inspiration Home

Enhance your space with William Stanek's evocative art. Each piece is crafted to inspire and uplift your everyday life.

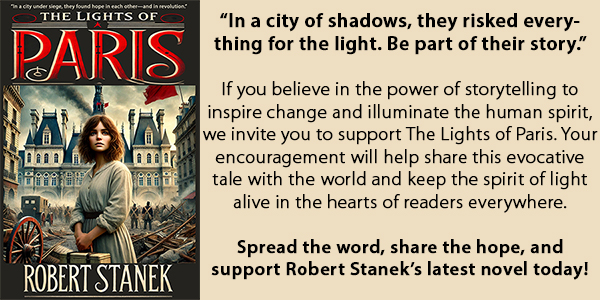

Support The Lights of Paris by Robert Stanek, William Stanek's pen name! Through vivid historical detail and deeply moving character stories, Robert takes readers on an unforgettable journey through one of history’s most transformative times.